Are Groceries Taxed In New Mexico . Counties and cities can charge an additional local sales tax of up to 3.563%,. There are a total of 140 local tax. groceries are exempt from the new mexico sales tax. while new mexico's sales tax generally applies to most transactions, certain items have special treatment in many states. new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Generally speaking, sales and leases of goods and. No, most grocery food items are exempt from new mexico's gross receipts. what purchases are taxable in new mexico? are groceries taxable in new mexico? The taxability of various transactions (like services and shipping) can vary from. eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries: new mexico state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact new mexico residents. all nm taxes.

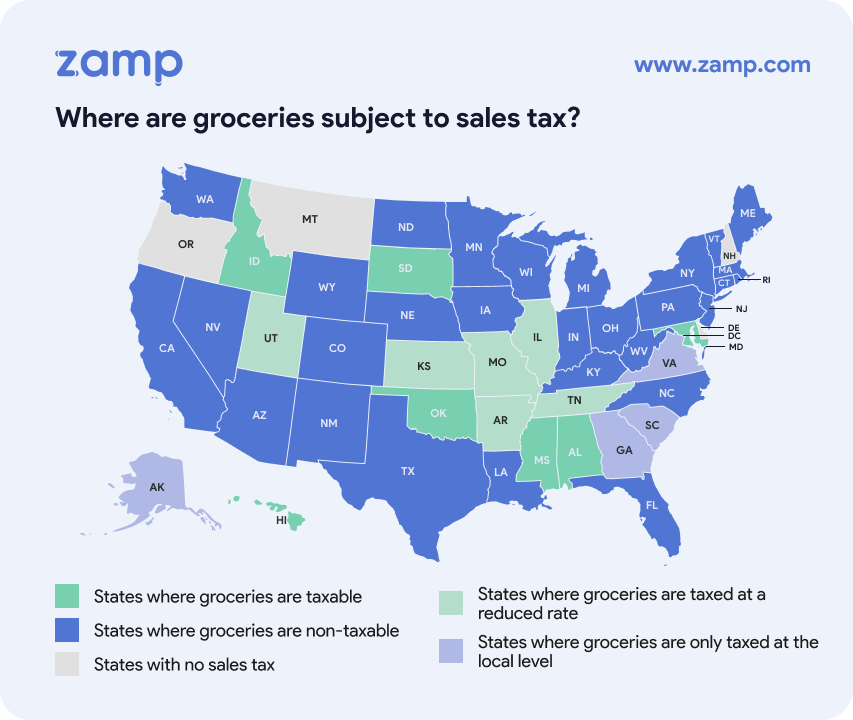

from zamp.com

while new mexico's sales tax generally applies to most transactions, certain items have special treatment in many states. Counties and cities can charge an additional local sales tax of up to 3.563%,. new mexico state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact new mexico residents. Generally speaking, sales and leases of goods and. all nm taxes. groceries are exempt from the new mexico sales tax. There are a total of 140 local tax. The taxability of various transactions (like services and shipping) can vary from. are groceries taxable in new mexico? No, most grocery food items are exempt from new mexico's gross receipts.

Sales Tax on Groceries by State

Are Groceries Taxed In New Mexico No, most grocery food items are exempt from new mexico's gross receipts. The taxability of various transactions (like services and shipping) can vary from. No, most grocery food items are exempt from new mexico's gross receipts. There are a total of 140 local tax. Counties and cities can charge an additional local sales tax of up to 3.563%,. Generally speaking, sales and leases of goods and. new mexico state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact new mexico residents. eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries: what purchases are taxable in new mexico? while new mexico's sales tax generally applies to most transactions, certain items have special treatment in many states. all nm taxes. are groceries taxable in new mexico? new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. groceries are exempt from the new mexico sales tax.

From luciendesantis.blogspot.com

new mexico gross receipts tax changes Neta Brannon Are Groceries Taxed In New Mexico groceries are exempt from the new mexico sales tax. Counties and cities can charge an additional local sales tax of up to 3.563%,. while new mexico's sales tax generally applies to most transactions, certain items have special treatment in many states. eleven of the states that exempt groceries from their sales tax base include both candy and. Are Groceries Taxed In New Mexico.

From www.nmvoices.org

Taxing groceries would make New Mexico’s food insecurity problem worse Are Groceries Taxed In New Mexico are groceries taxable in new mexico? while new mexico's sales tax generally applies to most transactions, certain items have special treatment in many states. Generally speaking, sales and leases of goods and. Counties and cities can charge an additional local sales tax of up to 3.563%,. new mexico has state sales tax of 4.875%, and allows local. Are Groceries Taxed In New Mexico.

From nm-us.icalculator.com

5k Salary After Tax in New Mexico US Tax 2024 Are Groceries Taxed In New Mexico Counties and cities can charge an additional local sales tax of up to 3.563%,. Generally speaking, sales and leases of goods and. groceries are exempt from the new mexico sales tax. new mexico state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact new mexico residents. are groceries taxable in new. Are Groceries Taxed In New Mexico.

From www.elpasotimes.com

Las Cruces Walmart taxes grocery deliveries after new bill took effect Are Groceries Taxed In New Mexico while new mexico's sales tax generally applies to most transactions, certain items have special treatment in many states. The taxability of various transactions (like services and shipping) can vary from. There are a total of 140 local tax. all nm taxes. new mexico state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes. Are Groceries Taxed In New Mexico.

From newmexiconewsport.com

Goodbye Tampon Tax New Mexico News Port Are Groceries Taxed In New Mexico The taxability of various transactions (like services and shipping) can vary from. new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Counties and cities can charge an additional local sales tax of up to 3.563%,. new mexico state tax rates and rules for income,. Are Groceries Taxed In New Mexico.

From luciendesantis.blogspot.com

new mexico gross receipts tax changes Neta Brannon Are Groceries Taxed In New Mexico The taxability of various transactions (like services and shipping) can vary from. No, most grocery food items are exempt from new mexico's gross receipts. eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries: what purchases are taxable in new mexico? are groceries taxable in. Are Groceries Taxed In New Mexico.

From www.salestaxdatalink.com

Sales Tax on Groceries Studied Sales Tax DataLINK Are Groceries Taxed In New Mexico all nm taxes. There are a total of 140 local tax. No, most grocery food items are exempt from new mexico's gross receipts. Generally speaking, sales and leases of goods and. are groceries taxable in new mexico? eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition. Are Groceries Taxed In New Mexico.

From taxedright.com

New Mexico State Taxes Taxed Right Are Groceries Taxed In New Mexico new mexico state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact new mexico residents. Generally speaking, sales and leases of goods and. new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. are groceries taxable in new. Are Groceries Taxed In New Mexico.

From topforeignstocks.com

Sales Tax on Grocery Items by State Chart Are Groceries Taxed In New Mexico No, most grocery food items are exempt from new mexico's gross receipts. are groceries taxable in new mexico? all nm taxes. There are a total of 140 local tax. Counties and cities can charge an additional local sales tax of up to 3.563%,. Generally speaking, sales and leases of goods and. what purchases are taxable in new. Are Groceries Taxed In New Mexico.

From thetaxvalet.com

How to File and Pay Sales Tax in New Mexico TaxValet Are Groceries Taxed In New Mexico The taxability of various transactions (like services and shipping) can vary from. are groceries taxable in new mexico? No, most grocery food items are exempt from new mexico's gross receipts. Counties and cities can charge an additional local sales tax of up to 3.563%,. groceries are exempt from the new mexico sales tax. all nm taxes. . Are Groceries Taxed In New Mexico.

From www.cbpp.org

States That Still Impose Sales Taxes on Groceries Should Consider Are Groceries Taxed In New Mexico all nm taxes. The taxability of various transactions (like services and shipping) can vary from. eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries: There are a total of 140 local tax. groceries are exempt from the new mexico sales tax. while new. Are Groceries Taxed In New Mexico.

From benniqemeline.pages.dev

Sales Tax In New Mexico 2024 Starr Emmaline Are Groceries Taxed In New Mexico The taxability of various transactions (like services and shipping) can vary from. what purchases are taxable in new mexico? new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. all nm taxes. are groceries taxable in new mexico? Counties and cities can charge. Are Groceries Taxed In New Mexico.

From www.communitycommons.org

A Health Impact Assessment of a Food Tax in New Mexico Community Commons Are Groceries Taxed In New Mexico No, most grocery food items are exempt from new mexico's gross receipts. while new mexico's sales tax generally applies to most transactions, certain items have special treatment in many states. what purchases are taxable in new mexico? all nm taxes. Counties and cities can charge an additional local sales tax of up to 3.563%,. There are a. Are Groceries Taxed In New Mexico.

From docs.stripe.com

Collect tax in New Mexico Stripe Documentation Are Groceries Taxed In New Mexico new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. new mexico state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact new mexico residents. groceries are exempt from the new mexico sales tax. There are a total. Are Groceries Taxed In New Mexico.

From mellieacker.blogspot.com

new mexico gross receipts tax due date Mellie Acker Are Groceries Taxed In New Mexico what purchases are taxable in new mexico? all nm taxes. There are a total of 140 local tax. groceries are exempt from the new mexico sales tax. No, most grocery food items are exempt from new mexico's gross receipts. are groceries taxable in new mexico? Generally speaking, sales and leases of goods and. new mexico. Are Groceries Taxed In New Mexico.

From taxpreparationclasses.blogspot.com

New Mexico Gross Receipts Tax Return Tax Preparation Classes Are Groceries Taxed In New Mexico all nm taxes. Counties and cities can charge an additional local sales tax of up to 3.563%,. what purchases are taxable in new mexico? new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. There are a total of 140 local tax. Generally speaking,. Are Groceries Taxed In New Mexico.

From zamp.com

Sales Tax on Groceries by State Are Groceries Taxed In New Mexico groceries are exempt from the new mexico sales tax. new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. all nm taxes. Counties and cities can charge an additional local sales tax of up to 3.563%,. eleven of the states that exempt groceries. Are Groceries Taxed In New Mexico.

From nmindepth.com

Lawmakers tackle raising the alcohol tax New Mexico In Depth Are Groceries Taxed In New Mexico No, most grocery food items are exempt from new mexico's gross receipts. groceries are exempt from the new mexico sales tax. new mexico state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact new mexico residents. new mexico has state sales tax of 4.875%, and allows local governments to collect a. Are Groceries Taxed In New Mexico.